The circular economy represents a fundamental shift in resource management, particularly in industries characterised by rapid technological advancement and frequent product turnover, such as the smartphone market. Transitioning from a linear economy—where resources are consumed, used, and discarded—to a circular economy is essential in addressing the environmental and economic challenges posed by the smartphone industry. This shift aims to eliminate waste and promote the continual use of resources, contrasting sharply with the traditional 'take, make, dispose' approach.

The Importance of Circular Economy Maturity in the Smartphone Industry

Measuring a company's efforts and success in implementing circular economy principles is crucial in the smartphone sector. As consumer awareness around sustainability increases, companies must adopt robust frameworks to stay competitive. The Circular Economy Maturity Model (CEMM) by Ingram Micro Lifecycle and Research HQ offers a structured way to evaluate an organisation’s progress towards circularity. The model measures performance across five pillars: Strategy & Governance, Resource Efficiency, Product Lifecycle Management, Stakeholder Collaboration, and Measurement & Reporting.

The Role of the 3 R’s in Circular Economy Maturity: Returns, Recovery, and Recommerce

Within the CEMM framework, the 3 R’s—Returns, Recovery, and Recommerce—are critical to driving circularity in the smartphone industry:

Returns: This involves managing customers' returns of smartphones, whether through trade-in programs, warranty returns, or take-back schemes. Efficient returns processes allow companies to systematically collect used devices, ensuring valuable components can be recovered, and devices can be effectively refurbished or recycled. This is often the first step in maximising the lifecycle of products.

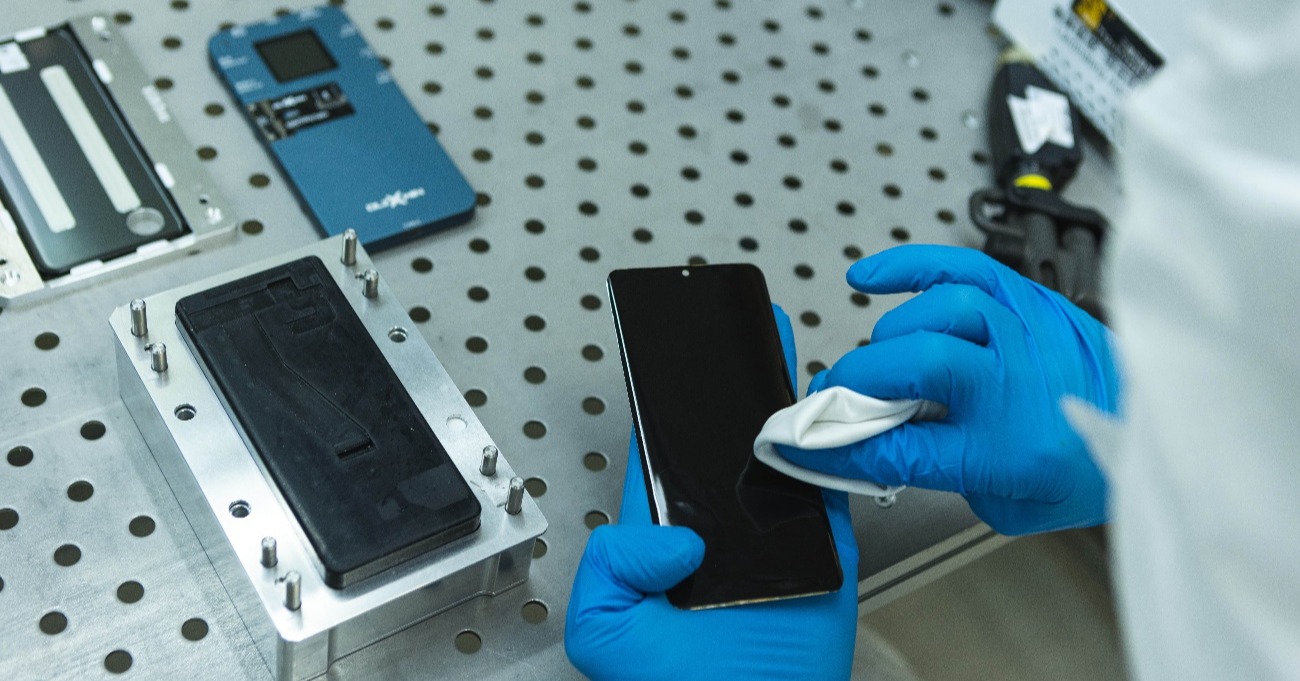

Recovery: Refurbishment and repairs are at the core of the recovery process, which focuses on restoring returned smartphones to optimal condition. This involves replacing defective parts, restoring battery performance, upgrading software, and ensuring the device's overall quality. For non-repairable devices, recovery also includes salvaging valuable materials such as lithium, cobalt, and gold, which can be reintroduced into the production cycle. This process breathes new life into smartphones, extending their lifespan and reducing the environmental impact of e-waste.

Recommerce: Once smartphones have been refurbished, they are reintroduced into the market via recommerce channels. Recommerce involves the sale of pre-owned or refurbished devices, meeting growing consumer demand for affordable, sustainable alternatives. This process helps companies generate additional revenue streams and fosters a more sustainable smartphone lifecycle.

These 3 R’s become increasingly important as companies progress through the maturity levels in the CEMM, enabling them to manage smartphone lifecycles efficiently and sustainably.

Maturity Levels: Progressing Towards Circularity in Smartphones

1. Provisional

Returns: At this stage, companies typically lack formal returns processes. Devices are often discarded with minimal recovery or refurbishment efforts.

Recovery: Limited refurbishment or repair activities exist, and companies need opportunities to restore or recycle valuable components.

Recommerce: Recommerce efforts are largely absent, with few structured systems for reselling refurbished or recovered products.

2. Reactive

Returns: Basic returns programs emerge, often driven by regulatory requirements or customer demand. However, these initiatives are inconsistent and lack comprehensive integration.

Recovery: Companies start refurbishing returned smartphones, but these efforts need to be expanded and are often driven by warranty repairs rather than a circular strategy.

Recommerce: Recommerce channels have been explored but still need to be developed more. Early-stage buy-back programs may begin at this level.

3. Structured

Returns: Formal returns systems are implemented, allowing companies to collect used smartphones systematically through trade-in or take-back schemes.

Recovery: Refurbishment and repairs are systematically integrated into the product lifecycle. Returned devices are restored to a saleable condition, and valuable materials are recovered.

Recommerce: Recommerce channels are established, with structured systems for reselling refurbished smartphones. Companies begin partnering with recommerce platforms to reach broader audiences.

4. Integrated

Returns: Returns processes are fully embedded into the business, allowing smartphones to be systematically collected and processed for refurbishment or recycling. AI and machine learning are often used to optimise the returns and collection process.

Recovery: Refurbishment and recovery are deeply integrated into the business model. Advanced tools such as automation and data analytics improve efficiency in refurbishing and recycling.

Recommerce: Recommerce becomes a central part of the business strategy. Refurbished devices are marketed alongside new products, with strong partnerships enabling seamless distribution and sales.

5. Optimised

Returns: Returns processes are optimised using predictive analytics, allowing companies to anticipate and manage customer returns. This ensures a steady stream of devices for refurbishment and recycling.

Recovery: Recovery processes, including refurbishment and material extraction, are optimised for maximum efficiency and minimal waste. Predictive tools help forecast recovery opportunities and streamline operations.

Recommerce: Recommerce channels are fully mature and generate significant revenue. Refurbished smartphones are seamlessly reintroduced into the market, and predictive analytics help companies anticipate demand and manage inventory.

Measuring Success in Circular Economy Efforts for Smartphones

The success of the 3 R’s in the circular economy can be measured through several key metrics, including:

Recovery Rates: Track the percentage of devices retrieved through trade-in or recycling programs, aiming for high recovery percentages to reclaim valuable materials like cobalt, gold, and lithium.

Refurbishment Efficiency: Measure how quickly and effectively smartphones are refurbished, including diagnostics, repairs, and component replacements. Cost savings per device can also be tracked to evaluate overall efficiency.

Recommerce Revenue: Monitor sales of refurbished smartphones, analysing profit margins compared to new devices and consumer preferences for refurbished products.

Additional Metrics

Life Cycle Assessments (LCA): Assess a smartphone’s environmental impact over its entire lifecycle, from raw material extraction to end-of-life disposal.

Material Flow Analysis (MFA): Track the flow of materials through the product lifecycle, identifying opportunities to optimise recovery, reduce waste, and minimise environmental impact.

Customer Feedback: Collect insights on refurbished devices' repairability, durability, and satisfaction. This feedback can help align product development and circular practices with customer expectations.

Opportunities and Challenges in the Smartphone Market

The smartphone market presents significant opportunities for circular economy practices. The global refurbished smartphone market was valued at $49.9 billion in 2020 and is expected to grow to $65 billion by 2024. Additionally, material recovery from e-waste, including smartphones, offers substantial cost-saving opportunities, with valuable materials such as gold, cobalt, and lithium contributing to billions in potential savings. However, challenges such as short product lifecycles, complex material compositions, and consumer expectations for frequent upgrades create barriers to implementing efficient circular systems.

Leading smartphone brands like Fairphone have embraced the 3 R’s. Fairphone’s modular designs, for example, facilitate easy repair and refurbishment, extending the life of devices and reducing the environmental impact of electronic waste.

The Urgency of Circular Economy Practices in Smartphones

With e-waste reaching unprecedented levels, the smartphone industry must adopt the principles of Returns, Recovery, and Recommerce to mitigate environmental impact. The Circular Economy Maturity Model (CEMM) provides a comprehensive framework for companies to move through the maturity levels, adopting sustainable practices that drive economic growth while preserving environmental resources.