The secondary smartphone market REVolution

Introducing a technology that can test and grade one million mobile devices per year.

The lightbulb moment that could change the secondary smartphone market forever...

Mark Twain said there are no completely new ideas. He argued instead that they are "simply old ideas put into a sort of mental kaleidoscope."

For Tim McGrath, senior engineer at Ingram Micro, the shaking of the kaleidoscope took place on a car journey in 2018. As the road stretched before him, Tim’s mind wandered to the mobile diagnostics business. Suddenly, an epiphany.

Tim noted that, even after a decade, the business of grading used devices was stubbornly slow. Human labor still did all the work. Almost every attempt by industry insiders to improve the process with technology had been unsuccessful.

But Tim was not an insider. Prior to his current role, Tim had worked in other electronics industries, some with very hightech analyzing tools and processes used to grade and test other kinds of electronic devices. He wondered: why not use the same technology to grade smartphones?

Tim called old colleagues in Detroit. Intrigued, they built a prototype. It worked beautifully.

Over the next two years, the Ingram Micro team refined this model. They also explored how to use robotic arms to perform multiple tests.

The result was the REV mobile diagnostics concept. A single REV machine can process up to 480 devices per hour – any make, any model, any condition. This is a 10x improvement on existing manual processing times.

The secondary handset market

Multiple factors are driving growth in a $25bn sector

2021 will be a breakthrough year for 5G adoption. This is great news for everyone working in the secondary handset market.

Why? Because every consumer that upgrades to 5G will have a 4G phone to recycle – and an army of aspiring 4G subscribers will be waiting to buy them.

According to a study by data security company Blancco, 68 percent of 5G customers say they will trade in their used devices. As a result, this could release 810 million smartphones into the refurbished market.

However, 5G is just the latest factor fuelling demand for used devices. Others include:

- Rising prices for premium smartphones. Top end devices are out of reach for many. When the iPhone X launched at $1000, it triggered a surge in demand for premium used devices.

- Longer upgrade cycles. Phones are more reliable than ever, which means they retain their resale value for longer. Today, the average price for a secondary market phone is $360.

- The Right-to-Repair movement. Across the world, lawmakers are launching regulations to make it easier for customers to repair products – and for manufacturers to extend guarantees. This is extending product lifecycles.

- Growing markets for recycled phones in developing countries. As 4G reaches more regions, customers are moving on from feature phones. This is fuelling a market for affordable smartphones.

- Rising demand from credit excluded customers. Every market includes a segment of customers who cannot get credit and are therefore unable to take advantage of carrier repayment deals on new phones.

Carriers have embraced the new market dynamics. They understand that 'certified pre-owned' (CPO) handsets can complement their subsidy plans, giving their customers more flexible upgrade options. As a result, many MNOs have increased the focus on this market opportunity. They have created 'asset monetisation' teams that actively promote CPO devices online and instore.

Thanks to the above factors, the secondary market is booming. Here are the key figures from IDC:

- 175.8 million CPO units shipped in 2018

- 206.7 million CPO units shipped in 2019

- 332.9 million CPO units projected to be shipped in 2023

A sector crying out for innovation

As we have established, the secondary smartphone market refurbishes more than 200 million devices a year. Every one of these handsets has to be appraised for performance and graded by cosmetic appearance.

A typical inspection will carry out as many as 100 functional tests (depending on the requirements of the customer) to provide a device grading.

The tested factors include:

- Charging

- Battery life

- Camera

- Microphone

- OS version

- Display

- Buttons

- Screen

- Casing

This is labour intensive work. Why? Because, in the usual scenario, people do most of the testing. Operators sort gaylord boxes of devices by model, charge them, and then perform tests one at a time.

The job is time-consuming. On average, it takes 250 operators to grade 1000 handsets per day this way, but the supply of devices can vary wildly across the year. It peaks when new models are launched, for example. These seasonal spikes make it difficult to maintain efficient staffing levels.

Clearly this is a process ripe for automation. However, after more than a decade, most attempts at technical innovation have failed.

There are two main reasons for this.

1. Cosmetic testing is too 'subjective'

What constitutes a 'serious' scratch on a screen? How wide? How deep? These are difficult questions to answer for a human tester and even more difficult for a machine to assess.

Most attempts to automate cosmetic testing use artificial intelligence to identify a flaw. In this process, the machine will compare a blemish against a library of stored images showing similar marks. But this means the machine can only 'recognize' something familiar and within the existing database. It will also struggle to distinguish between – for example – a scratch, a fingerprint, and a human hair.

The result is often false positives.

2. Time-consuming setup

Most testing machines can handle only one phone model at a time. As a consequence, human operators have to change the settings for the machine every time they load a new device type. They also have to ensure all handsets are fully charged before testing starts. The laborious setup cancels most gains made possible by automation.

Fast and accurate testing = more profit for resellers

The secondary smartphone market relies on a speedy turnaround of its inventory. Age matters. Every week of delay knocks some resale value from a used device. Of course, this adds to the pressure to make tests fast.

The same goes for accuracy. Resellers cannot make money if devices are incorrectly graded. The risk of returns is innately high – especially in the e-commerce space, where customers cannot inspect products before making a purchase.

Accurate testing also helps vendors to know which products are suitable for 'grade skipping'. Resellers can boost their profits considerably when they move a device up a grade by repairing faults or fixing cosmetic flaws. To do this, they need to be sure they choose the right handsets to improve.

Robotics, continuous processing, photometrics

With REV, Ingram Micro has found a way to automate the cosmetic grading and diagnostic testing of smartphones.

Two key innovations make this possible:

1. REV brings the phone to the testing

In previous attempts at automated device testing, the phone was moved around. Human operators would take a device from one machine to another to perform different assessments.

REV reverses this process. Phones are placed on pallets that move around a continuous circuit. Robotic arms perform different tests. The device stays within the circuit and the processing is brought to the phone.

2. Photometric analysers do the cosmetic grading

Cosmetic grading has proven to be the biggest hurdle for machine testing. With REV, Ingram Micro solves this problem by adapting photometric techniques in order to

identify and grade blemishes on the screen or casing.

REV: A walk-through

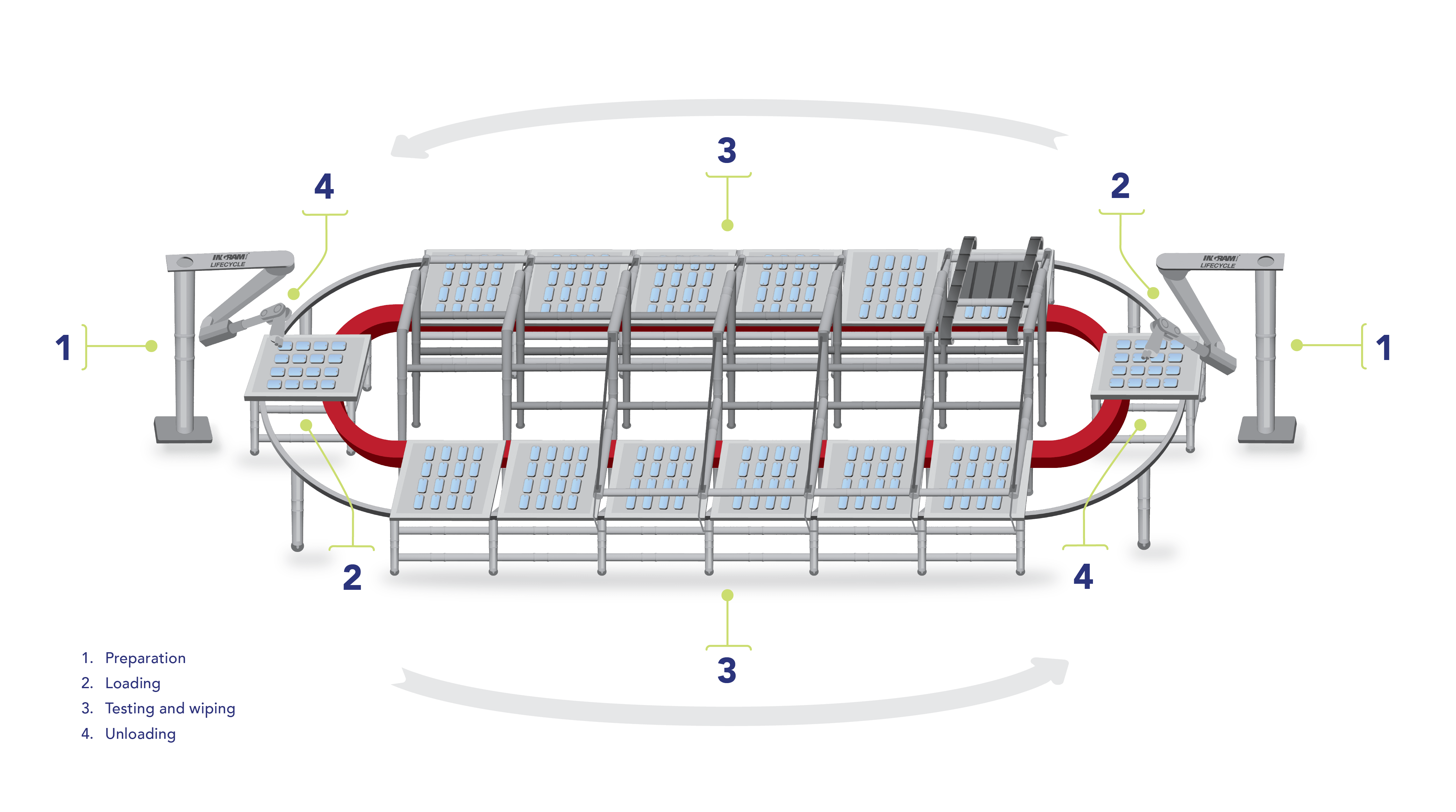

As we have established, REV machines perform continuous processing by holding phones in place and bringing the tests to the devices. Let's explore the six steps that make this work.

1. Operators plug in the devices. At this stage, the devices are also loaded with software and a QR code, which allows the REV system to complete various functional tests.

2. Robotic arms place phones on 16 pallets, which can each support 16 phones. The pallets keep the devices plugged in across the entire process. This means the phones are always being powered so there is no need for pre-charging.

3. The pallets move around a 20 ft x 4 ft oval ‘racetrack’ circuit. It takes half a circuit to complete a test, so REV can process two batches simultaneously.

4. At various stages of the circuit robotic arms perform multiple functional tests on the devices. Customers can specify which tests are needed.

5. The final test is for cosmetic grading. This is the point at which REV takes a hi-res photo and uses photometric scanning to identify blemishes.

6. The devices complete their journey around the oval circuit. Robotic arms remove them at unload stations. Devices are then divided into two categories: ‘suitable for improvement’ (i.e grade skipping) or 'put away'.

Of course, there is more to the REV solution than its robotic arms and pallets. The other side of REV is the software engine that controls the hardware.

This engine runs scripts to ensure that customer requirements are followed. It offers real-time dashboards that display individual device statuses. It also keeps a record of all testing data so that customers can make better decisions about what to do with their devices. The data can be used to advise on how to repair or upgrade a device.

REV in numbers

The productivity gains from REV are remarkable.

A single REV machine can process around 480 devices per hour - that's nearly 1m devices a year.

That represents a 10x improvement on the current industry standard for processing times.

In addition to improving output, it also reduces labor costs associated with device processing. Just four people are needed to run the process, compared to the 250 it takes to achieve a similar outcome.

Today, average grading and testing costs run as high as $20 per device. REV has the potential to halve this outlay.

Your next step

At last, machine processing has come to the mobile diagnostics business.

Demand for used smartphones is booming. In 2018, specialists processed 175.8 million used devices. Experts believe they will need to recycle 332.9 million in 2023.

As we’ve discussed, there are a number of reasons for this. New premium device models are more expensive than ever. Product lifecycles are getting longer. Customers in developing markets want affordable options.

And then there’s the 5G upgrade factor, which promises to to unleash a flood of quality 4G devices onto the used market.

REV is Ingram Micro’s response to this surging market. Human operators can use one REV machine to test and grade up to 480 devices per hour, improving the industry average by 10x.